The Southeast Asia Startup Talent Report 2023 unveils the latest hiring trends and compensation data for startups in the era of sustainable growth

Any startup founder will tell you that building and scaling a startup is a feat in and of itself in the best conditions. But it’s particularly challenging when there’s limited insight on hiring and retaining the right talent.

To address this pain point for founders across the region, we first unearthed compelling insights into how the startup compensation and talent landscape was evolving with the launch of our first-ever Southeast Asia Tech Talent Compensation Report in 2021.

Many founders we spoke with found the report helpful as it managed to capture the nuances that startups face. Recognizing the impact the report had made on our startup ecosystem, we decided to carve out a new iteration. This time, with renewed focus and a fresh pair of lenses.

Table of Contents

ToggleWithout further ado, we are excited to announce the launch of the Southeast Asia Startup Talent Report 2023 — a follow-up to our highly successful 2021 report with an all new set of bigger, better insights.

A joint research report by Glints and Monk’s Hill Ventures, this newest iteration offers a more extensive set of salary and equity data for founders, C-suites and startup talent, as well as a sweeping view of the latest startup trends in the era of sustainable growth.

Our report this year also encompasses more than 10,000 data points for startup tech and non-tech talent, over 150 founder and C-suite data points, and over 40 interviews with founders, VCs, and operators from Singapore, Indonesia, and Vietnam.

The economic landscape has changed significantly since the release of our last report in 2021. This year’s edition comes off the back of great uncertainty for many startups, with the backdrop of a post-pandemic bear market enormously shifting the narrative.

Gone are the heydays of explosive growth, high valuations, free money, and a grow-at-all-costs mentality. For many startups, an unprecedented time begets an unprecedented shift. Founders are making swift and difficult decisions that have a profound impact on their companies and people.

Collectively, all of this speaks to a need to relook at organizational blueprints. While there is no existing playbook for steering a startup through times of crisis, we’ve seen some common themes emerging from the founders, industry peers, and operators who have been on the frontlines.

“Attracting and building high-performance teams remain top of mind for founders and their teams – particularly in a climate where founders and their teams have to do more with less while achieving positive unit economics. There is still much more to do to provide the tools for employers and talent in startups to make informed decisions about their talent strategy. This report is hopefully one step forward in supporting the community as we believe the strongest founders, talent, and companies will emerge from Southeast Asia in this era of sustainable growth,” said Oswald Yeo, co-founder and CEO of Glints.

Through proprietary data and expert interviews, The Southeast Asia Startup Talent Report 2023 aims to shed some light on the latest compensation and startup trends — to empower founders as they navigate the road to positive cash flow and profitability.

Here are some of the key findings you can find in the report.

The increased number of data points we received from founders this year has given us a bigger picture of the state of C-suite salary and equity across markets, as well as the variables that affect them. That being said, CEO and CTO roles continue to be the two cornerstone roles at the founder level for most startups.

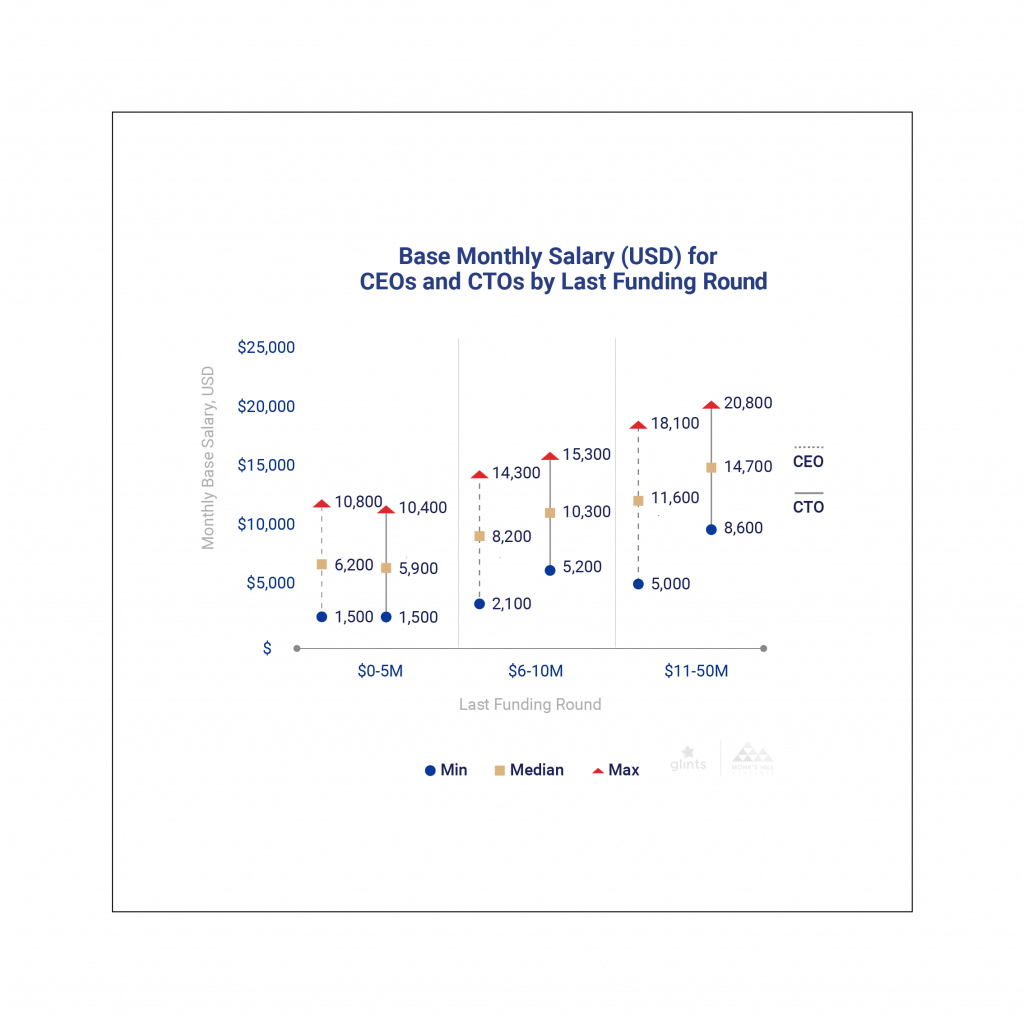

Overall, the median salaries for CTOs tend to be higher than CEOs at the early stage as CEOs take on more sweat equity. However, salaries for founders and C-suites have substantially increased since our last report. For example, at the $0-5M stage of funding, the median salary for CEOs has grown by 2.4x. As a whole, Singapore-based CEOs and CTOs have the highest base salaries as compared to their Indonesian and Vietnamese counterparts, which is likely due to the higher cost of living.

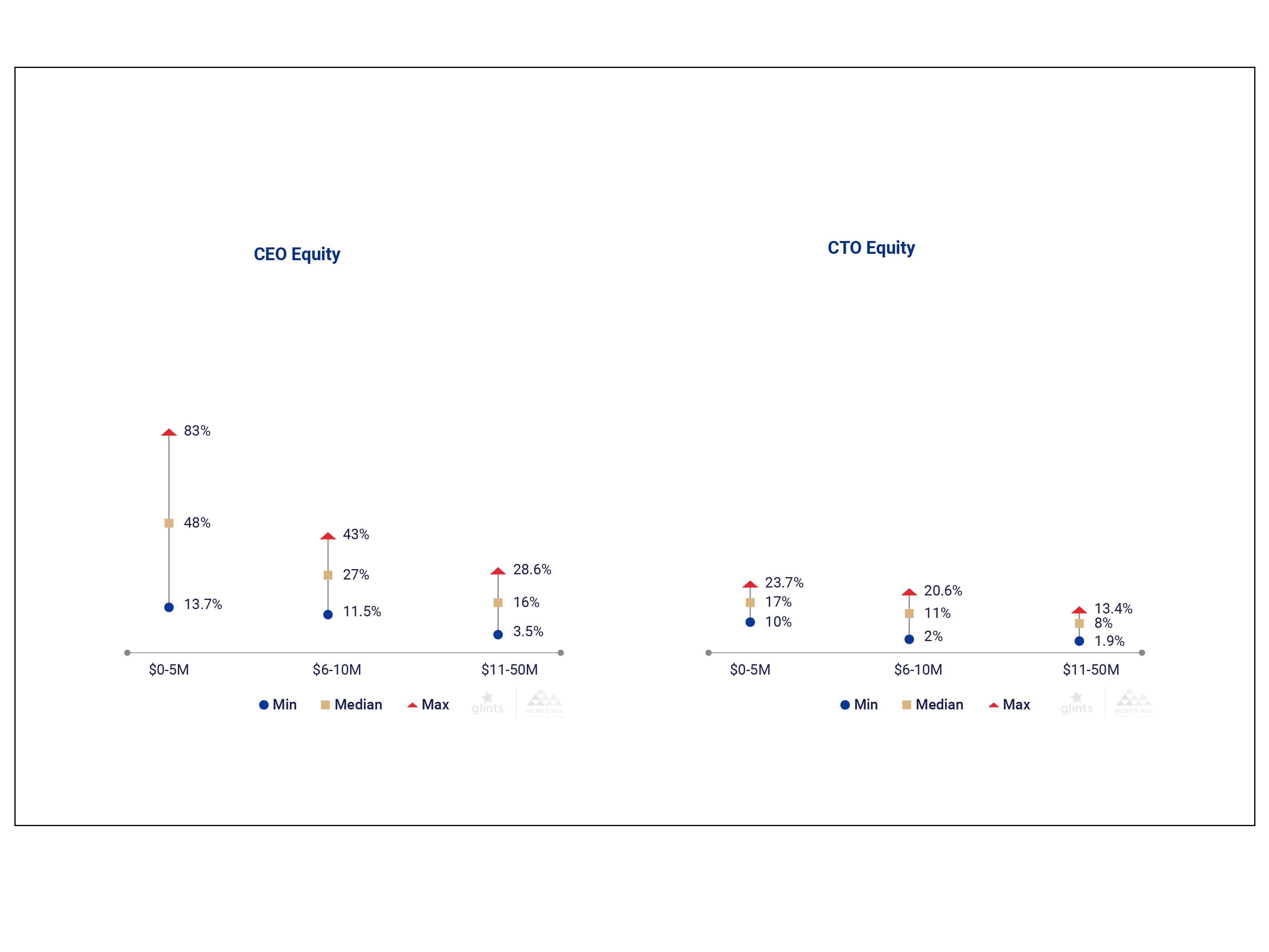

In terms of equity ownership, the spread continues to be the highest for CEOs at the earliest stages of the company. However, founder equity will decrease over time with more investors on the cap table.

We also noted that with investors becoming more cautious, we anticipate that founders will give up larger chunks of equity to secure funding and stay alive. Our data reflects a 5% drop in CEO equity in the $0-5M range and a 9% drop in the $6-10M range from 2021.

These insights into founder and C-suite salaries and equity will prove invaluable to startups who are keen to know how their peers are adapting to a year of tough fundraising ahead.

2023 will be a strange year for attracting, hiring, and retaining talent, as founders today are devising new strategies to stay or reach default alive. We found that startups are investing more in revenue-generating roles and shying away from opportunistic hires.

As a result, there is a surplus of supply over demand for some tech roles, particularly at the junior level. For senior tech talent, hiring will stay competitive as the talent pool is still small, but demand has decreased somewhat as tech companies pull back.

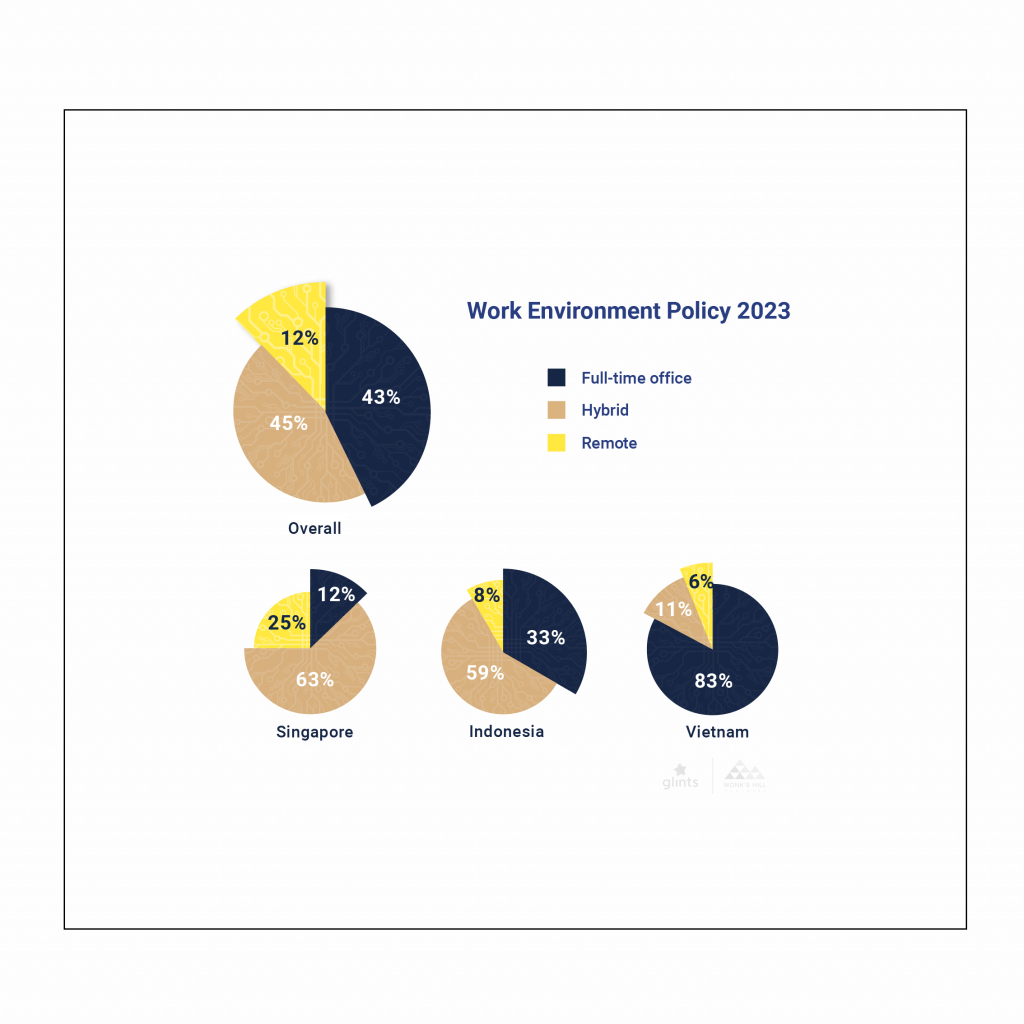

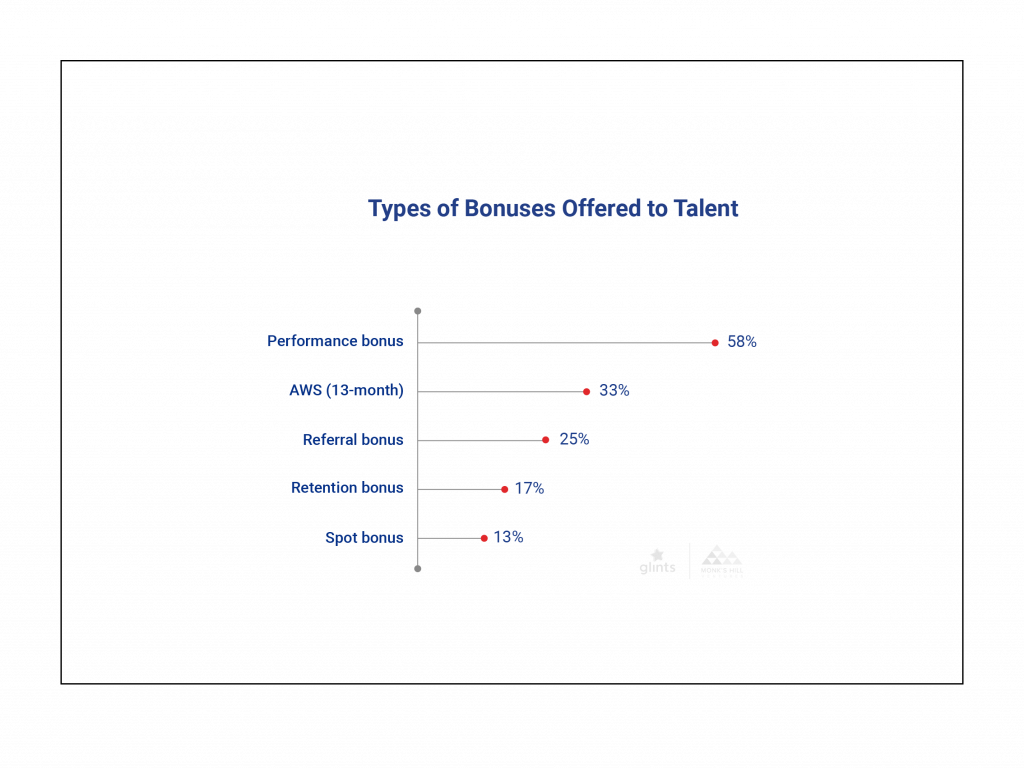

On a positive note for founders who are looking to hire cost-consciously, this has trickled down to tech talent compensation. Some founders opined that salary expectations will come down, and there would be greater emphasis placed on ESOP, workplace flexibility and performance bonuses. In fact, both founders and operators expect to have more reasonable salary increment conversations with potential hires.

Zooming into priority hires, many startups are taking a wait-and-see approach as they become more conservative with whom they hire going forward. Regardless, we found that businesses will still double down on fundamental roles as they shift their focus to building a better product and greater revenue.

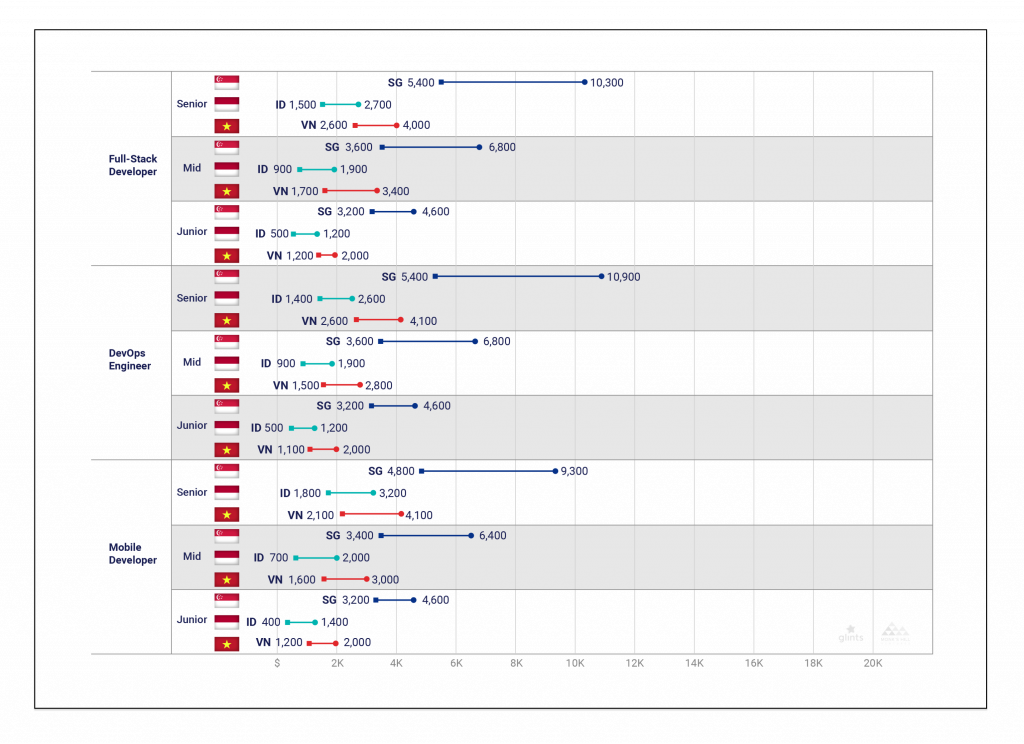

Engineers are still the most sought-after talent in Singapore, Indonesia, and Vietnam and among all tech and non-tech roles. Currently, the highest-paid engineers are in Singapore, earning at least thrice the amount in Indonesia and Vietnam.

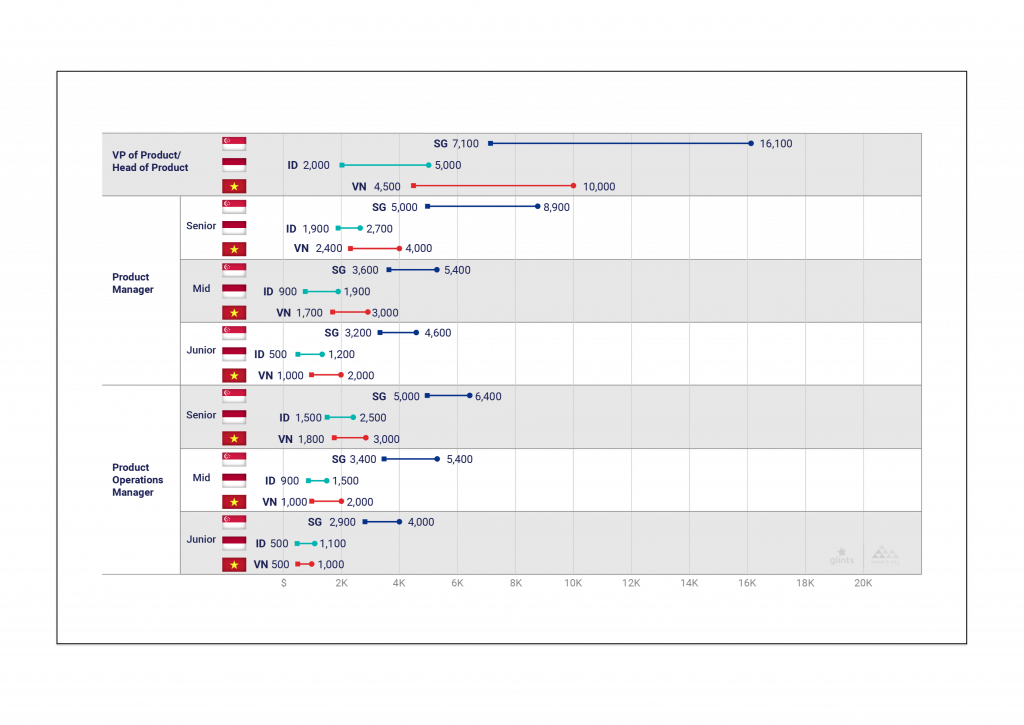

We also analyzed other functions such as Product, Data Science, Business Development & Sales, and Marketing & PR, including how their salaries changed over the past year and how these roles have grown in importance.

For example, product roles are a key priority for early-stage startups to support product-market fit. However, product roles are still relatively nascent in Southeast Asia and there is still more demand than supply. As a result, product managers saw the highest increment among all tech roles, with a median increase of 27% compared to the last report.

In addition, business development and sales roles are also taking center stage, as over 60% of startups will prioritize these roles in 2023. These insights can prove vital to founders who are becoming more judicious and prudent with their hires and will instead, look to upskill and redistribute internally.

During times of crisis, most founders will need to put on their wartime hat and find ways to navigate choppy waters. Our report also features several lessons learned from founders and investors who have been in the trenches.

One of the most important lessons is to cover the nuts and bolts of compliance across markets before going through with a restructuring exercise. Being proactive with external counsel from the get-go and clarifying the legal requirements in advance will speed up the logistical planning required for execution.

We also explored the importance of consistently maintaining company morale. For founders, honesty, authenticity, and transparency are key when communicating why and how decisions are made. During difficult times when employees are tolerating a great deal of change, founders must also take a temperature check on the team’s health and assess whether they are still committed to the startup vision and mission.

Ultimately, there is a silver lining, and we’ve seen throughout history that the strongest companies will emerge more successful than before.

“There has been no better time to build high-performing teams in Southeast Asia. Despite headwinds, the region is poised for growth with tech innovations taking center stage and investments flowing in to back this stream of sustainable growth. There is a lot of ground to cover for startups to attract and retain top talent in the current climate. I am confident that the report will be a crucial catalyst in helping founders make informed decisions about navigating hiring strategy,” says Peng T. Ong, co-founder and Managing Partner of Monk’s Hill Ventures.

The startup ecosystem in Southeast Asia remains bright, and we hope The Southeast Asia Startup Talent Report 2023 provides founders with the impetus they need to navigate the path to longevity and profitability. We would also like to thank the founders, industry experts, and talent who participated in this report by sharing their time, guidance, and insights.

The Southeast Asia Startup Talent Report 2023 is now available for download. Get your free copy today!

This article is brought to you by Glints TalentHub. Leading companies are actively building their borderless teams in Southeast Asia, Taiwan, and beyond. However, the prospect of going borderless can be daunting due to complex regulations and cultural ambiguities. With Glints TalentHub, you’ll have a dedicated team of in-market legal, HR, and talent experts by your side at every step of the way.

Glints TalentHub offers an end-to-end, tech-enabled talent solution that encompasses talent acquisition, EOR, and talent development. We empower businesses to leverage the strengths of regional talent efficiently to build high-performing, cost-efficient teams.

Schedule a no-obligation consultation with our experts to receive a tailored proposal today.