Hiring in 2023: Where employers are hunting for talent in Southeast Asia

2023 is a year of great uncertainty – employers and talent are faced with geopolitical instability, rising interest rates, inflation, and recessionary fears. While blockchain and crypto hiring may have taken a back seat, the introduction of ChatGPT and other generative AI tech raises concerns about what jobs and industries will be taken over by AI.

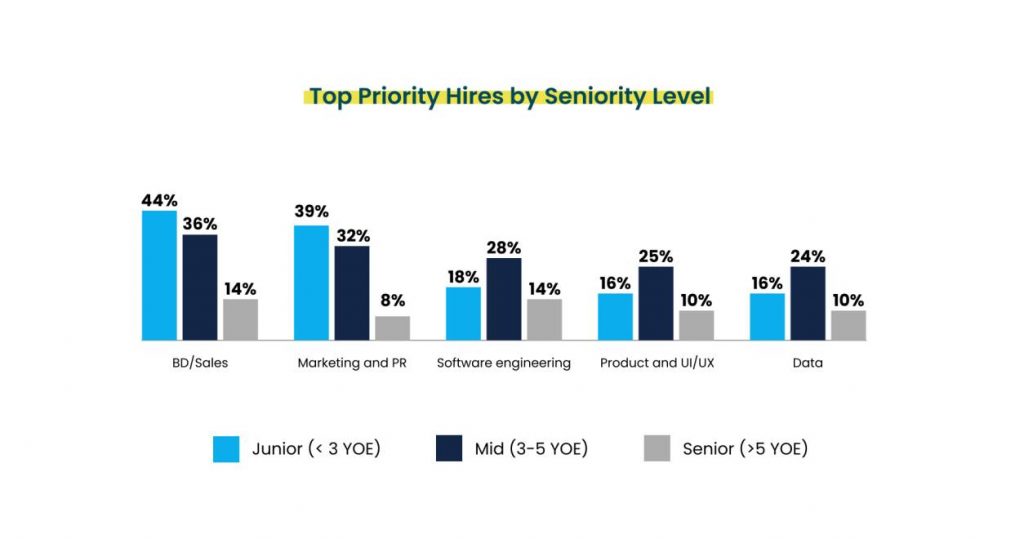

Interestingly, we see demand for tech talent taper off, and revenue-generating roles increase as companies refocus on business fundamentals. In uncertain times, businesses will want to focus on investing in revenue-generating units, including sales and marketing. As a result, we expect to see back office teams, particularly larger enterprises, ramped up to handle increased business activity in a post-pandemic period.

As tech companies pull back, software engineering will remain essential but relatively reduced in magnitude. Still, as one can expect, they remain in demand relative to supply as businesses undergo digital transformation.

We ask 219 employers across industries in Indonesia, Singapore, and Vietnam for their views and hiring sentiment for 2023. We also tracked China employers who are expanding their business and talent base to Southeast Asia. Finally, we looked at hiring sentiment among the region’s startups, SMEs, and MNCs. Here are our top findings:

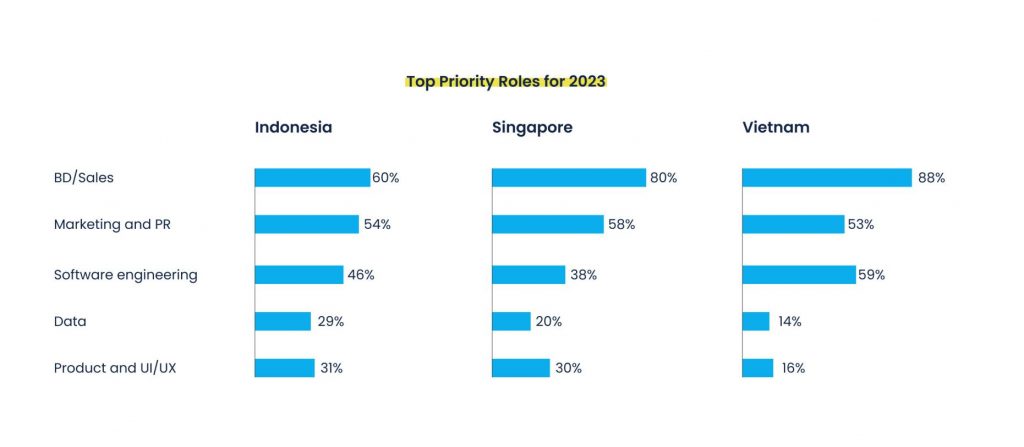

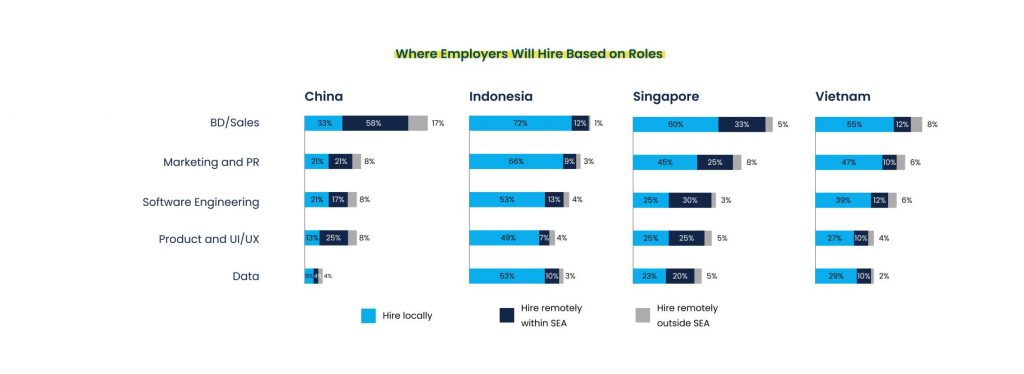

Revenue-generating roles are taking center stage this year as business development and sales are the top priority across Indonesia, Singapore, Vietnam, and China.

The top three roles across markets are within BD and sales, marketing and PR, and software engineering. For China companies, tech and product capabilities are usually not an issue as they have a proven model from China. However, the biggest challenge is localization, so a key focus is to find the right business development hire to set up the local team.

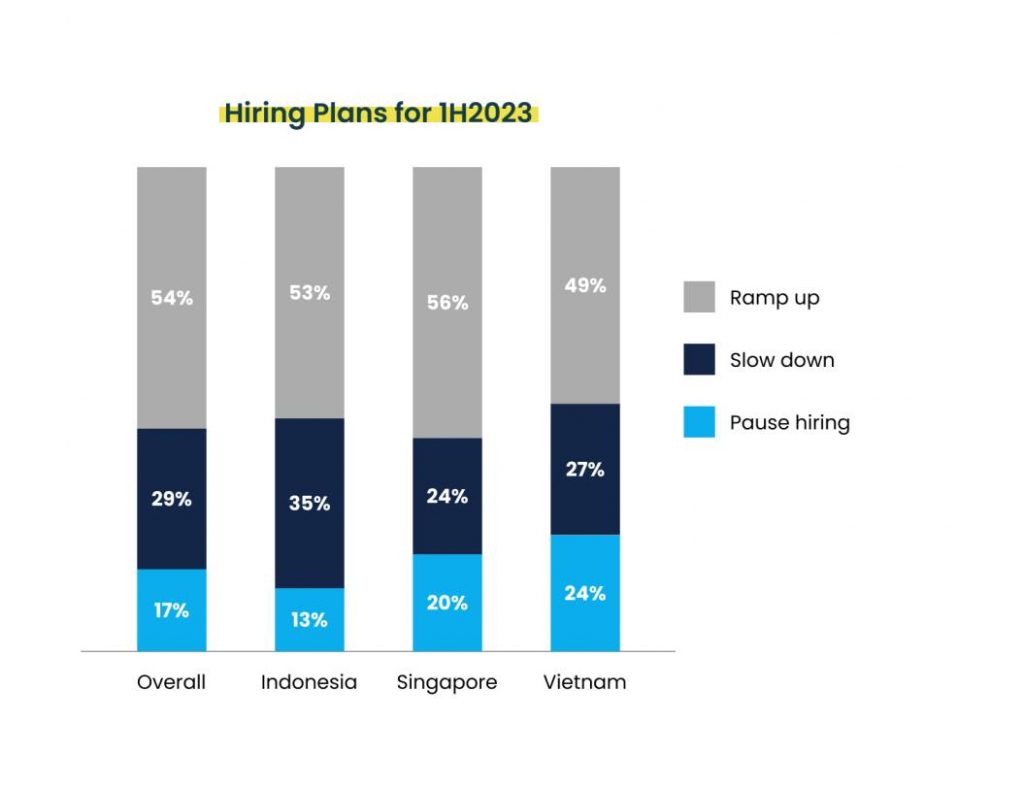

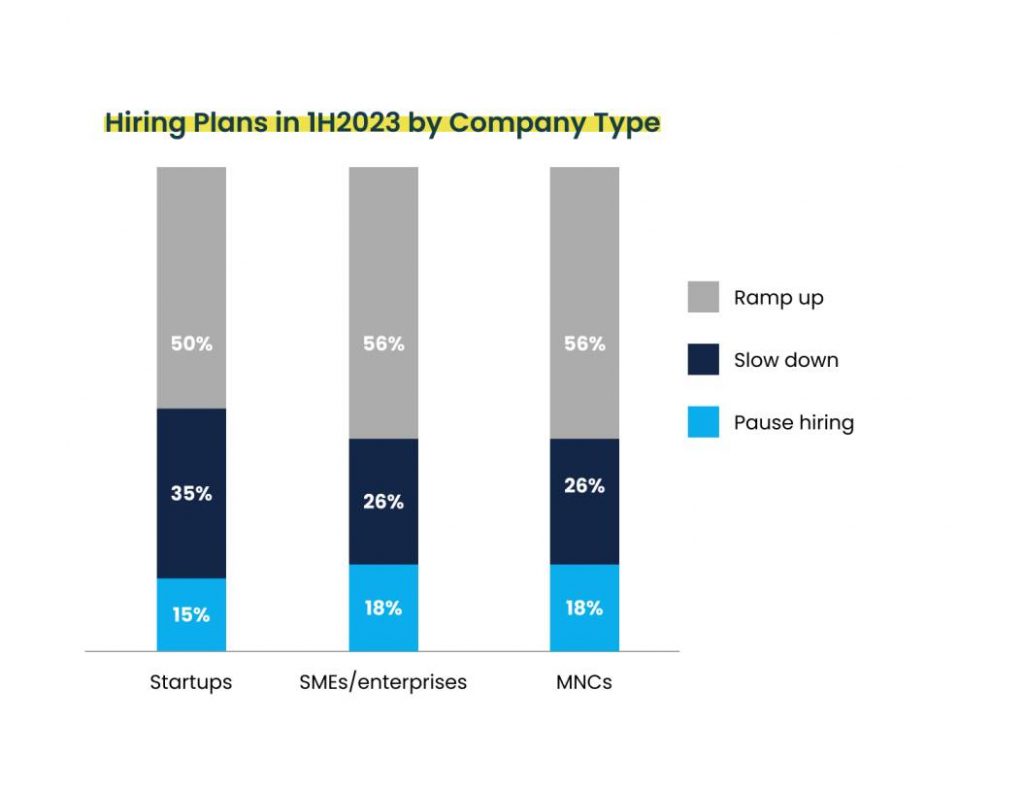

83% of surveyed companies expect to continue hiring in 1H 2023. For China companies, Southeast Asia is a market for expansion or a region to support expansion globally.

Of the 63 tech startups we surveyed, 35% will likely slow down their hiring in the next six months as they cut costs and conserve money.

Many startups we spoke with are also looking to redistribute teams internally. Startups are most sensitive to movements in the capital market, so when the fundraising environment is challenging, dampened hiring sentiment is not surprising. On the other hand, some dry powder still has to be deployed within a specific timeframe, so we expect startups in the region to be more bullish than in the US or Europe.

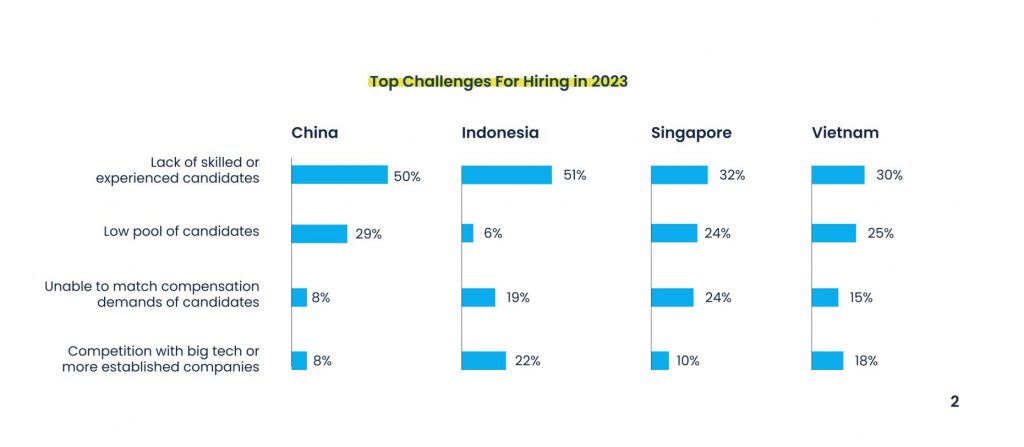

While there is still a shortage of tech talent, employers feel that the key challenge for hiring in the next six months is the need for more skilled or experienced candidates.

In Indonesia, the talent issue is further exacerbated as the majority of talent is based in Jakarta (as most companies are also headquartered in Jakarta), so when looking to fill a demand for a role outside Jakarta, the talent pool of skilled or experienced candidates is further limited.

Like what you see? Subscribe to our newsletter to receive all our latest news and offers delivered right to your desk.

If we zoom in on what level of experience are being hired (though this can also be a function of the supply in the individual markets), junior to mid-level candidates are prioritized for business development and sales roles, and marketing & PR.

Employers seek mid-level candidates with a stronger skill set for technical roles like software engineering.

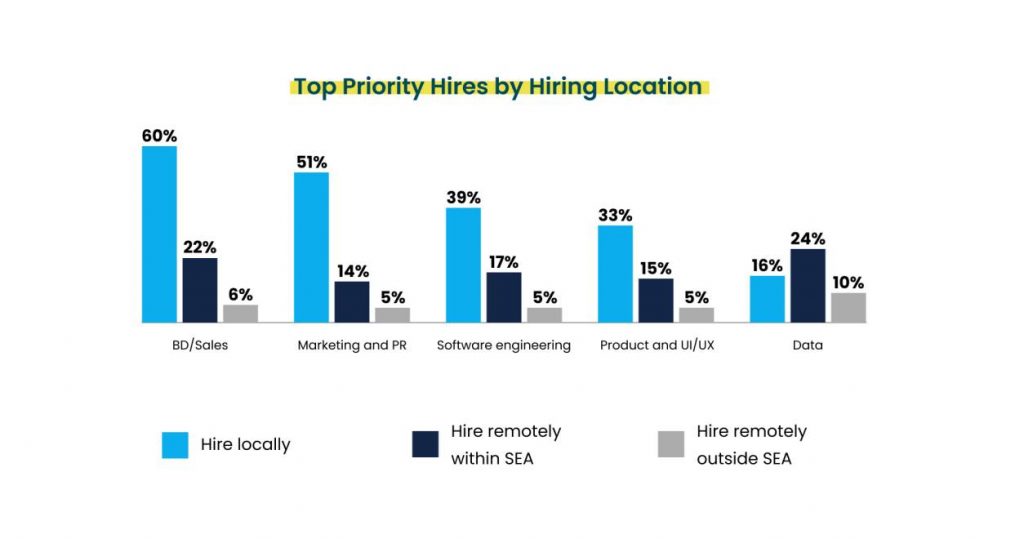

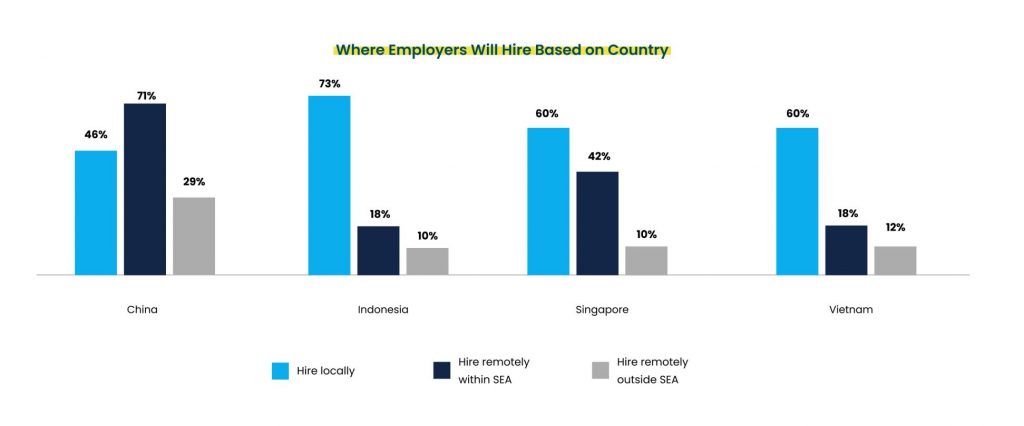

While remote work is becoming more commonplace, most employers still value finding people where the company or operation is based.

However, 71% of China respondents are increasingly looking to find talent in Southeast Asia to reduce dependence on a single market as they see increased competition for talent within China.

Employers are also looking to access the pool of tech and non-tech talent that is more cost-efficient. Many China companies are also looking for alternative tech hubs where they can hire candidates who can speak Chinese.

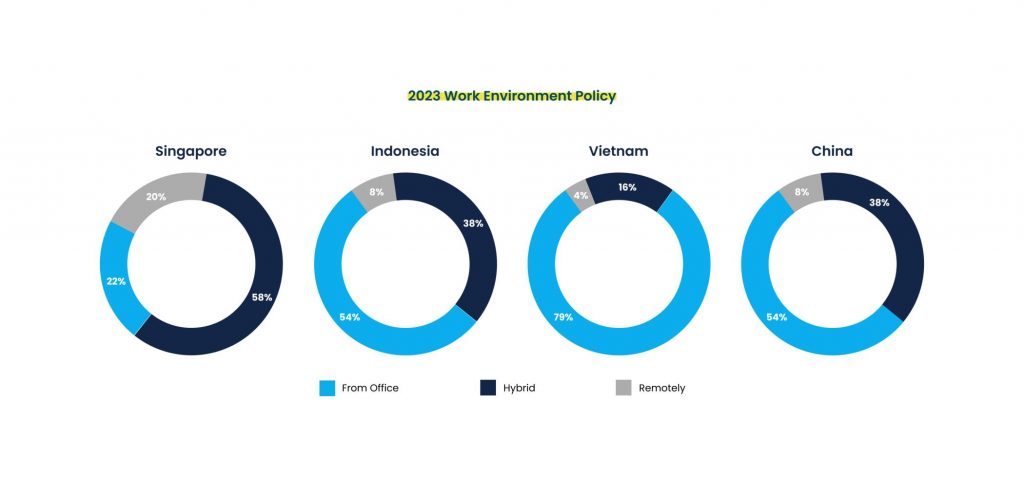

There is a strong preference for Vietnam employers to have employees work from the office.

For instance, 79% of respondents in Vietnam prefer employees working from the office. Meanwhile, 54% of respondents in Singapore have a hybrid work environment. More westernized economies are less ready to push for work from an office in the post-pandemic which is why we see Singapore, relative to the rest of the markets, show the strongest resistance to work from the office.

However, we expect that there will be a broader shift to work from an office or a hybrid model as compared to a fully remote working environment, particularly as the labor environment tips towards an employer vs. employee market.

This article is brought to you by Glints TalentHub. Leading companies are actively building their borderless teams in Southeast Asia, Taiwan, and beyond. However, the prospect of going borderless can be daunting due to complex regulations and cultural ambiguities. With Glints TalentHub, you’ll have a dedicated team of in-market legal, HR, and talent experts by your side at every step of the way.

Glints TalentHub offers an end-to-end, tech-enabled talent solution that encompasses talent acquisition, EOR, and talent development. We empower businesses to leverage the strengths of regional talent efficiently to build high-performing, cost-efficient teams.

Schedule a no-obligation consultation with our experts to receive a tailored proposal today.

.